Due to the global coronavirus pandemic we have all had the opportunity to test our risk tolerance in the last couple of weeks. Some of us might have realised that our level of tolerance isn´t quite what we thought it should be, when the market was still making double-digits. What about Mr. Become FI and myself? I am very delighted to say that neither one of us has been panicking about the downturn that started right after our portfolio passed the 100 000 euros mark and we celebrated this milestone with a bottle of sparkling wine!

Where does this calmness come from? Are we simply born to be investors? Maybe there is some natural calmness in our nature – after all, we didn´t buy any extra toilet paper nor a single can of beans or noodles more than usually in the last couple of weeks!

However, 1,5 years ago my investor mindset surely wasn´t what it is today. When we paid our bank a visit back in the autumn of 2018 my intention was to put our money in a low-risk, and therefore low-return fund. Not knowing anything about how the stock market works but assuming, that we could lose all our money on it, this seemed like the right way to go. (By the way, you can lose all your money if you buy individual stocks and the company goes bankrupt or the shares lose their value forever!).

The bank staff had us take a risk tolerance test to find the proper investment for us. One of the questions on the form was „What would you do if the market drops?“

a) sell my stocks

b) nothing

c) buy more stocks

I knew “sell“ was the wrong answer. I wanted to say „do nothing“ but I think my husband answered „buy more“. But that´s certainly not the truth about where I was at that point! So how come my biggest concern at this moment is not having enough cash to put into the market?!

Knowledge is key

Over the past year we have spent quite some time learning about the stock market and the mindset of a successful investor. If you are to read only one book on investing we suggest you read JL Collins „The simple path to wealth“ and/or his Stockseries. This skilled and confidence-inspiring man, who has been investing for 40 years, wiped out our last doubt about whether investing in the stock market is a good idea. For us, understanding of the market was key to „toughen up and enjoy the ride“ as Collins urges us to do.

This is what made us tough

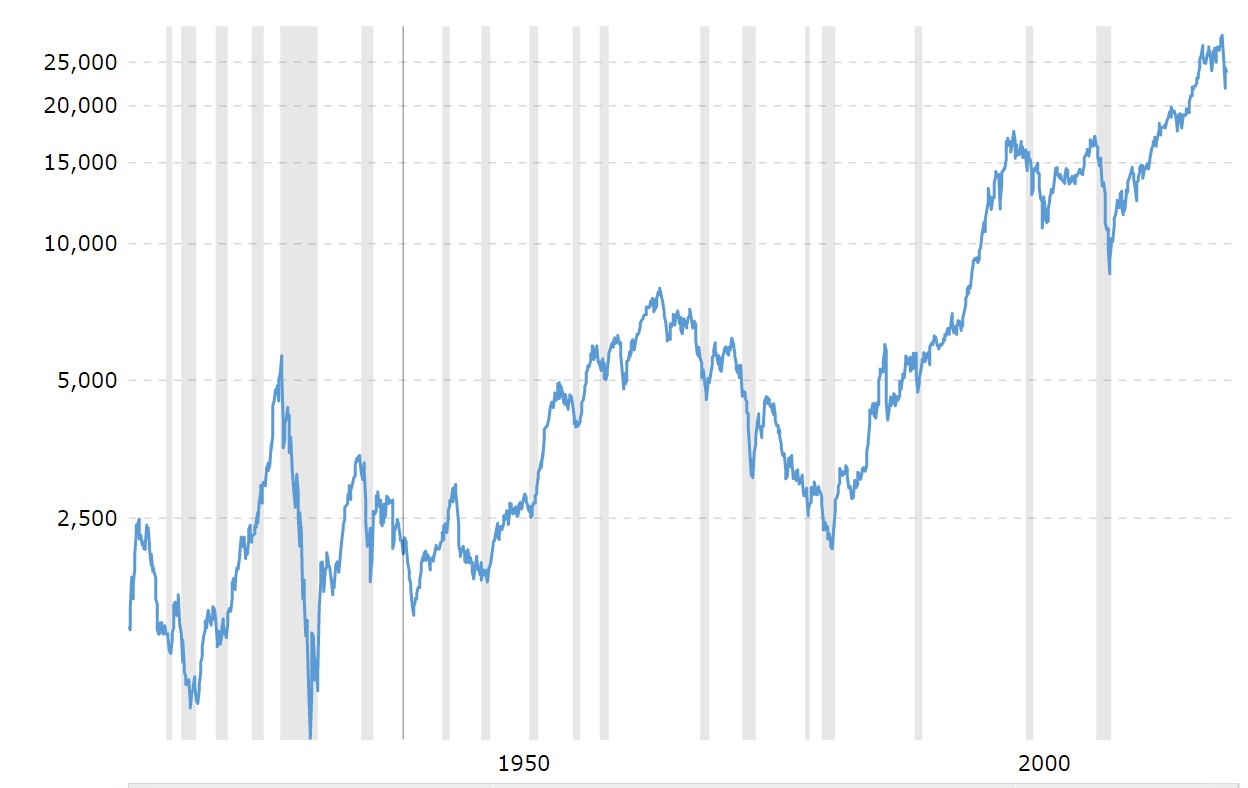

1. The knowing that market crashes are to be expected. It has happened before and it will happen again. And again. JL Collins told his 20 year old daughter that in her 60-70 years of investing she will experience 15-20 melt downs.

2. The reassurement that the market always recovers and goes up. Always. And, if someday it really doesn’t, no investment will be safe and none of this financial stuff will matter anyway.

Picture: Historic chart Dow Jones

Picture: Historic chart Dow Jones

3. Our loss is only a paper loss until we sell and turn it into a real loss. Even when the market return is negative, we still own the same piece of the companies as we did the day when the market was positive. And when the bear market is over those pieces will be significantly more valuable.

Our financial situation

Our jobs aren´t more secure than anyone else´s in these days. However, we are still not worried about our financial situation. How come?

- Our financial situation is stable. We owe a mortgage-free house and a summer cottage. We owe a rental property with a modest mortgage.

- We spend way less than we earn (about 50 % of our salaries).

- And, we live in Finland and are entitled to social security.

The Social Insurance Institution of Finland (Kela/FPA) provides basic economic security for everyone living in Finland. For example, an unemployed parent with two children will receive about 40 euros a day. However, most employees including ourselves, are members of a union or have a private unemployment insurance. This means the insurance will pay us, at least for the first year of unemployment and in case of lay-offs, about 70 – 80 % of our gross salary.

So, in this case we have an advantage compared to our fellow FI-ers in the US. We do not risk being without income two weeks from now. However, in these days there might be some severe delays in paying out benefits, since due to the corona crisis the general unemployment fund YTK received more applications regarding lay-off and unemployment in one month than it normally handles in two years!

Two of our favourite podcasts ChooseFI and Afford Anything have been discussing how big an emergency fund needs to be, normally and in exceptional times like these. Three to six or six to nine months' worth of spending is a pretty common „truth“ in the FI-community in the US. Naturally the answer to this question is as personal as everything in personal finance. Because we will have money coming into our account every month even in case of unemployment, thanks to our unemployment insurance, we don´t see the need to grow our emergency fund as large as it might be wise for someone living in the US. At the moment we have about six months’ worth of spending in cash. On the other hand – an emergency fund doesn´t only consist of cash. If we would have a real emergency, we always could sell some stocks, even though that should be the last way out.

So yes, now we buy stocks on a regular basis in addition to our monthly contributions and we have the facts on hand to back that up. As mentioned in the beginning, shortly before the downturn our portfolio crossed the 100 000 euros mark. But that was actual with gains and our principal was about 83 000 euros. Now, our principal crossed the 100 000 euros mark – like said: Better to buy stocks than toilet paper even though you could both consider “paper” assets

And we are not stopping here, as long as the markets are down, we will continue to put extra chunks of cash into our portfolio. We believe that will help us greatly on our journey towards FI. There is nothing better than buying stocks for deflated prices when you are still in the wealth accumulation phase.

After all, for people like Mr. Become FI and myself with about ten years left on our journey towards FI and therefore ten years away from drawing down our portfolio, this is the best thing that could happen, as the wise JL Collins reminds us.